Everything You Need to Master Your Finances

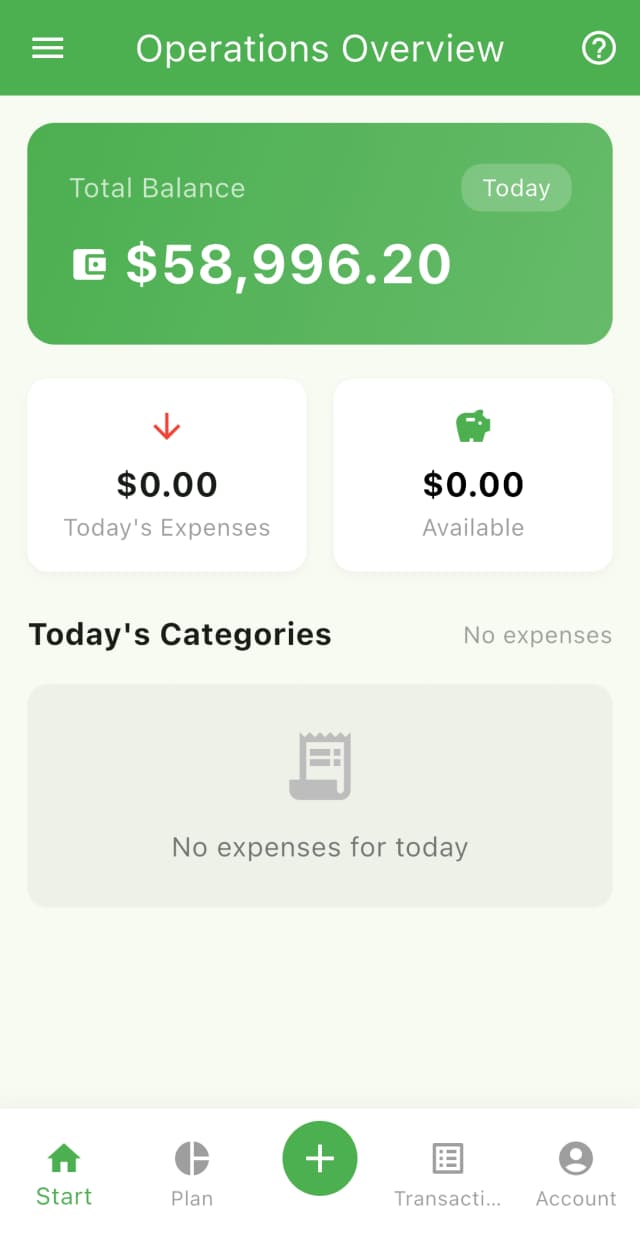

LetzSave combines powerful budgeting tools with smart insights to help you take control of your finances and achieve your financial goals faster.

Why Most People Struggle with Money Management

You're not alone. Studies show that 78% of Americans live paycheck to paycheck, and the average person has less than $1,000 in savings. The problem isn't your income—it's the lack of simple, effective tools to track and control your spending.

Living Paycheck to Paycheck

No Idea Where Money Goes

Complicated Budgeting Apps

Failed Savings Goals

How LetzSave Makes Budgeting Simple

Forget complicated spreadsheets and time-consuming manual entry. LetzSave automates your financial tracking so you can focus on achieving your goals.

Connect Your Accounts

Securely link your bank accounts and credit cards. LetzSave uses bank-level encryption to keep your data safe.

Automatic Categorization

Our smart AI automatically categorizes your expenses into meaningful groups like groceries, entertainment, and bills.

Set Your Goals

Define your savings targets and spending limits. LetzSave will help you stay on track with smart notifications.

Watch Your Progress

See your financial health improve with beautiful charts, insights, and personalized recommendations.

The average user saves $600 in their first month and $6,000 their first year

And we don't like to play favorites or anything, but you seem well above average to us.

Are you ready to be our next success story?

Frequently Asked Questions

Everything you need to know about LetzSave. Can't find the answer you're looking for? Feel free to reach out to our support team.

Yes! LetzSave is completely free to use. The app is free without any paid plans or subscription fees.

Your data is fully secure because we don't use any bank connections. Since LetzSave doesn't connect to your bank accounts, your financial data remains completely private and safe.

No, you don't need to connect your bank accounts. The app doesn't require any connection to bank accounts - it's fully safe. You can manually add your transactions and manage your budget without any bank integration.

Absolutely! LetzSave supports tracking multiple bank accounts, credit cards, and investment accounts. You can see all your finances in one place, making it easier to track your complete financial picture.

LetzSave focuses on simplicity and automation. While other apps require hours of setup and daily maintenance, LetzSave learns your spending patterns and provides insights with minimal effort from you. Plus, our AI-powered recommendations are personalized to your financial goals.

Our smart AI analyzes your transaction descriptions, merchant information, and spending patterns to automatically categorize expenses. You can also create custom categories and rules. The system learns from your corrections and becomes more accurate over time.

Still have questions? We're here to help!

Contact Support→